Financial Check-In: Debt Repayment

About half a year ago I did a book review about “Total Money Makeover”.

I wrote about my financial situation when I was with my ex-husband, and how my then financial situation was pretty dire. I also mentioned that despite my dislike for how out of touch Dave Ramsey was and how the book didn’t age well given the current circumstances, he did give some sound financial advice: get together an emergency fund, then debt snowball, then get a bigger emergency fund together, etc.

In the same blog post I mentioned that when I was finished with University and had a lot of student debt, “Total Money Makeover” gave me a starting point and a guiding path on how to pay it back and save money. Logically, if this method worked so well in the past, then I should have been able to make it work starting from last September.

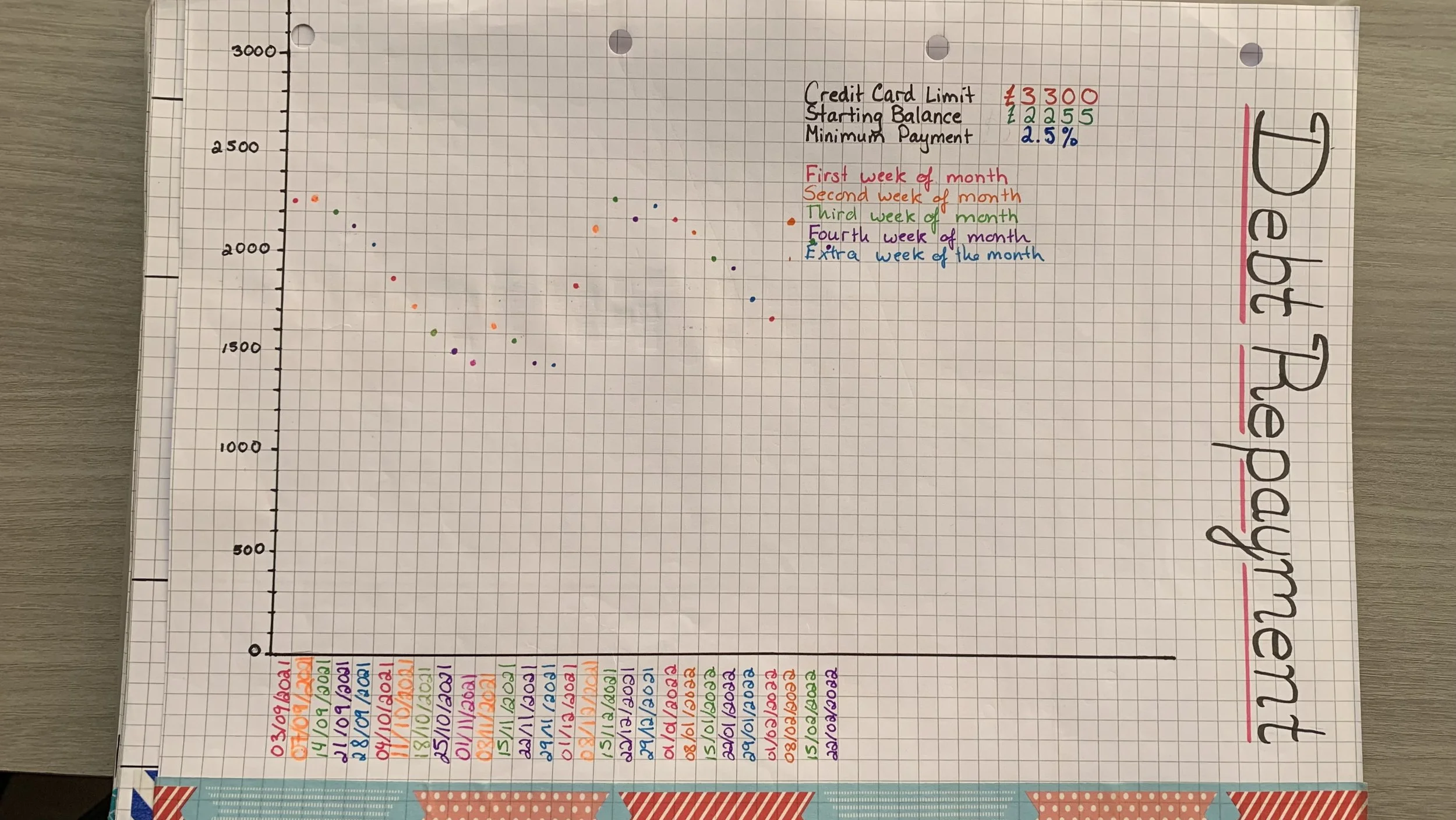

But it didn’t, because I didn’t follow the exact steps Dave Ramsey outlined. Instead of creating an emergency fund, I decided to throw all of my money into paying off my credit card. This was working for a while. As you can see by my hardcopy debt tracker that I was doing quite well for a while.

That is… until an emergency occurred.

And then not just one, but multiple.

My husband got into a car crash and I had to rush to Morocco. Then Christmas happened and I was (not?) surprised how quickly money was spent. I mean, some Christmas goodies only become available at Christmas after all. Then my car was having trouble passing its MOT and needed repairs...

Of course it was all going to go on my credit card: I didn’t have an emergency fund to dip into.

Am I going to change anything? Am I going to put aside £1000 in cash when we are still encouraged to be cashless (Come on, what else do you think the increase in the contactless limit was for in the UK)? Or will I keep putting the most amount of money into my credit card to pay off that as quickly as I can so I don’t have to worry about interest rates (The APR is brutal)?

Difficult to say.

When I first followed the advice of “Total Money Makeover” I was pretty settled in Canada. I wasn’t planning on moving to the UK right at the moment. Cash was still very much a thing. The stability allowed me to pay off my debt, save money, and enjoy my life a lot (read: bought a lot of Lululemon).

I’m not in the UK while I’m posting this, which highlights my nomadic lifestyle presently and how difficult it is to:

have stability long enough to plan more than a couple of weeks into the future,

make any long terms plans because of the lack of stability,

make any concrete financial decisions that don’t involve me putting out fires because of point number one.

But also, cash?

Even Moroccan shops and cafes are starting to accept card transactions, albeit a minimum spend of 100 dirhams.

I definitely need to find someone who will provide me with solid advice that is relevant in today’s world, but also doesn’t simply flog Cryptocurrencies.

My debt needs to disappear because I feel like I’m in constant limbo until it does. I don't feel like I can make solid financial choices and plans until it’s gone. But I also know that my financial situation won’t improve until I have more stability in my life.

And stability comes at a price.